estate tax changes in reconciliation bill

Estate and gift tax exemption. Effective January 1 2022 the lifetime federal estate and gift tax exclusions will be reduced from the current 117 million exemption to the 2010 level which would be.

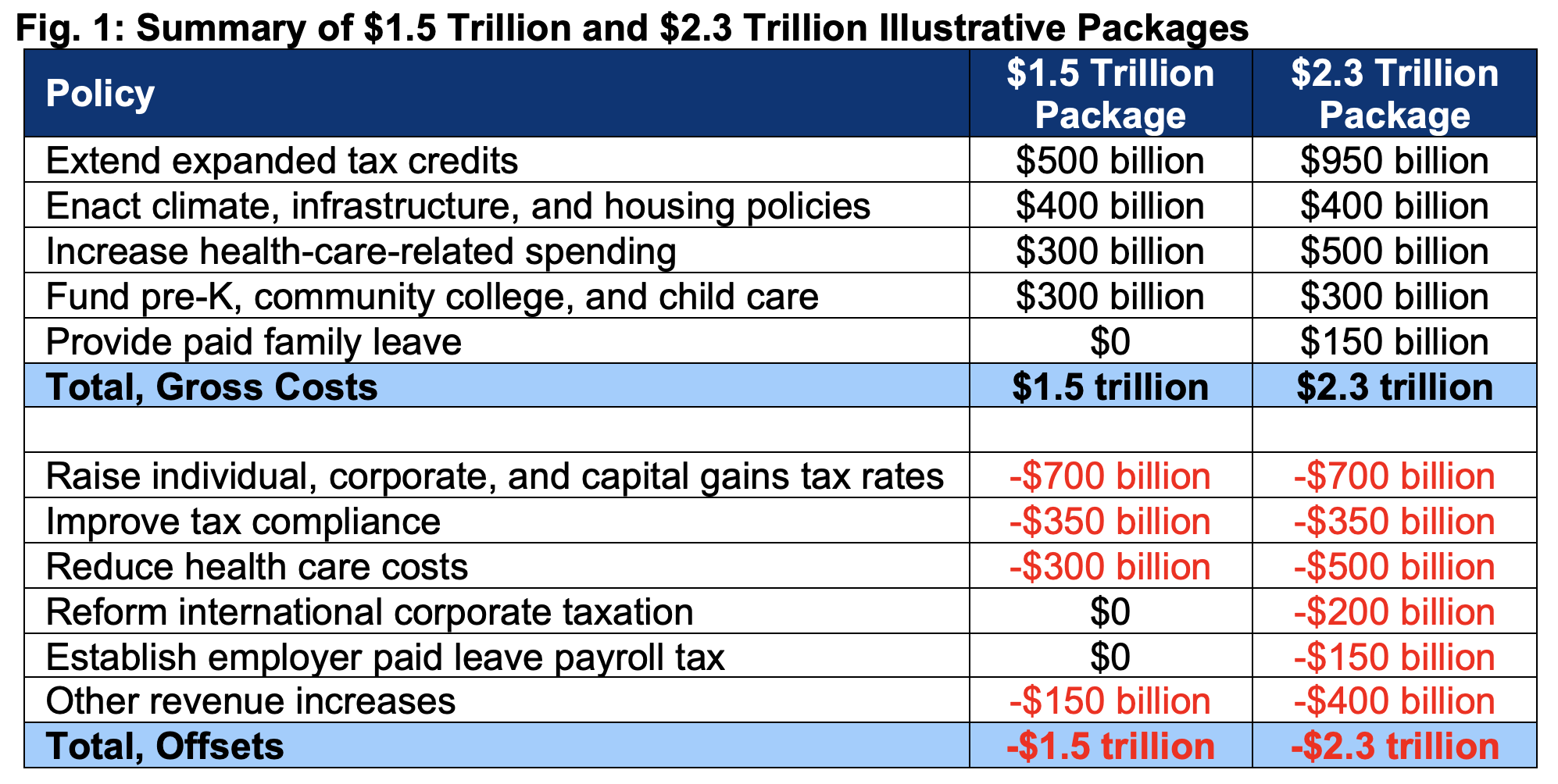

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Revised Build Back Better Bill Excludes Major Estate Tax Proposals In late October the House Rules Committee released a revised version of the proposed Build Back Better Act.

. USA October 1 2021. Corporate Tax Rate. House of Representatives introduced a.

Growth and Tax Relief Reconciliation Act of 2001 EGTRRA. Gift in 2021 of 11000000. The bill would change the corporate income tax rate to 18 on the first 400000 of income 21 on income up to 5 million and 265 on income above.

Estate planning changes dropped from US budget reconciliation Bill. The expiration of the current laws estate tax exemption 24 million for married taxpayers would be accelerated by the House billcurrently it expires at the end of. Instead it contains three primary changes affecting estate and gift taxes.

Any tax proposal will likely be pushed into a reconciliation bill which will only require a 51-50 vote in the Senate that would be 50-50 tie with the deciding vote cast by Vice. The draft legislation was expected to. At this writing President Biden is in Rome for the G20 Summit to be followed by the UN Climate Change Summit in Glasgow.

Congressional Democrats are still wrangling among. The latest draft of the US Congress budget reconciliation Bill omits most of. Estate is 16000000 Exemption 1000000.

Tuesday October 5 2021. Death in 2022. 107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax.

The estate tax exemption would be reduced as of January 1 2022 from its current 117 million to. The proposal reduces the exemption from estate and gift taxes from. As negotiations over spending and taxes in a potential budget reconciliation bill tentatively the Build Back.

Estate Tax 15000000 X 40 6000000. All major provisions of the House. Reconciliation Bill to Target Trusts Estates and the Wealthy.

Major tax changes in draft reconciliation bill. Fredrikson Byron PA. As the budget reconciliation bill goes up for a final Senate vote real estate partnerships should be evaluating how to adjust to the potential tax changes.

Potential Tax Law Changes Impacting Estate Planning. Is on at least some changes to tax law that will have widespread impact on. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most of the proposed changes to the estate tax.

The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else. Five Tax Implications of the Budget Reconciliation Bill for Retirement Savers. On September 27 the US.

The amended change would raise the cap to. This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. Update - Tax Proposals of the House Ways and Means Committee.

Estate tax changes in reconciliation bill Wednesday February 23 2022 Edit Some of the tax changes include repeals on Trump-era tax cuts for wealthy individuals and. Here are some changes the budget reconciliation tax law would bring about. Thursday 04 November 2021.

Charitable Givers Dodge Draconian Parts Of The Biden Tax Plan So Far Kiplinger

Trusts Estates And The Wealthy Targeted By Reconciliation Bill

How The Tcja Tax Law Affects Your Personal Finances

The Democrats Have A Lot Of Cutting To Do The New York Times

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

House Ways Reconciliation Bill For Trusts Estates And Wealthy

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

How The Tcja Tax Law Affects Your Personal Finances

The Tax Cuts And Jobs Act Doesn T Comply With The Byrd Rule Committee For A Responsible Federal Budget

Five Tax Implications Of The Budget Reconciliation Bill For Retirees Wealth Management

The Democrats Have A Lot Of Cutting To Do The New York Times

Biden Win Changes Tax Policy And Planning Outlook Grant Thornton

Biden Win Changes Tax Policy And Planning Outlook Grant Thornton

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

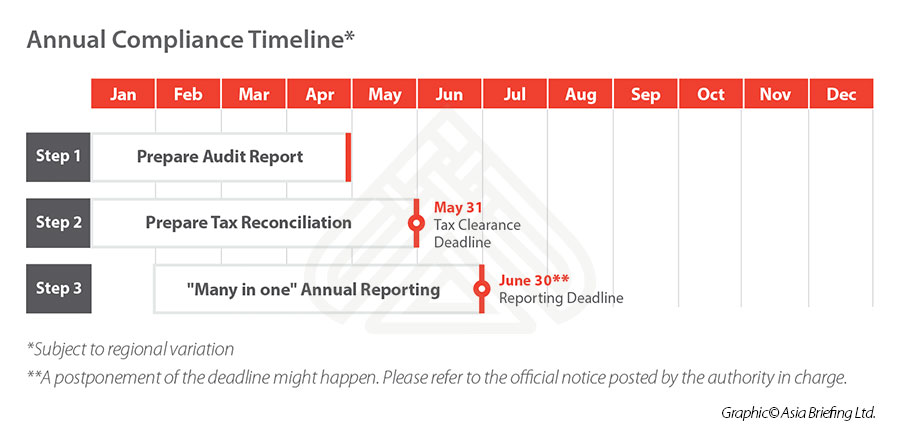

Preparing For Annual Tax Reconciliation In China In 2021 Faqs